|

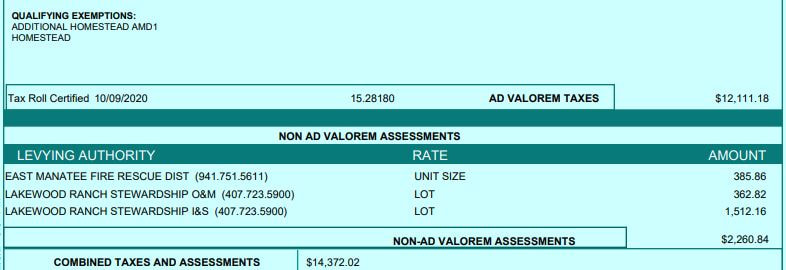

When you are considering buying a home in Florida, one of the main questions you will ask yourself will probably be "what are the annual taxes?" Florida taxes are a mystery to many, but today we try to explain a bit more about taxes, how to find tax bills for homes, and what the Homestead Exemption could mean for you as a homeowner. It is not a very easy mathematical equation to figure out, but we wanted to share some helpful tips on ways to find out what taxes are on similar homes and determine if you are eligible for any tax exemptions. First of all, you want to figure out which county the home is located within because each county can have different tax systems and millage rates. Our video above focuses on Manatee County, specifically. The County Property Appraiser's website is going to be a wealth of knowledge for you as you explore different exemptions and tax information. Once there, type in the address of the property you want to look up and click "Search". This will bring up a screen with a ton of information about the home, including all of the tax exemptions listed. The Tax Bill will list all components of the total tax amount, including any non-ad valorem taxes- which in Lakewood Ranch, make up the Stewardship or CDD fees. The totals listed indicate which amount you pay depending on how early you pay your taxes. For new construction, we like to estimate that the taxes will be about 1.5% of the purchase price of the home. That would include the CDD fee, and may be over-estimating in some cases, but it is a good starting point. The Homestead Exemption essentially decreases your home value for tax purposes by $50,000, assuming your home is a primary residence. To download your Guide to Homestead Exemptions, click here! Also, the “Save Our Homes” amendment limits, or caps, the annual increase in assessed value of property that has a homestead exemption. The increase cannot exceed the lesser of 3% or the Consumer Price Index (CPI) for the previous year. The assessed value cannot be greater than the market value. These two initiatives combined help to save money on your property taxes as a Florida resident. For more information and FAQs, download your guide. Or contact is with questions! 941-348-2653 [email protected]

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

|

Charles Rutenberg Realty

8130 Lakewood Main Street | Suite 103 | #404

Lakewood Ranch, FL 34202

941-348-2653 | Sitemap | Accessibility

RSS Feed

RSS Feed